BTL – Wrap Services

Given all the Landlord-related tax changes that have been introduced since 2017, Black Book offers a highly efficient and cost effective service designed specifically for new and existing Landlords.

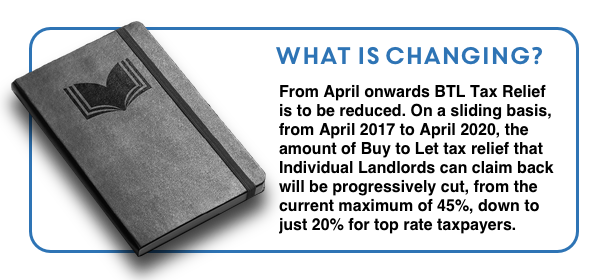

The Buy to Let Tax Relief changes (since April 2017) directly impact all Landlords – both existing and new – and many are now considering the use of a specially-formed Limited Company (‘SPV’) to help mitigate the impact of the changes.

There are several tax advantages to be gained in setting up a Limited Company to hold BTL properties, but there are disadvantages too, so it won’t be right for everyone. It is therefore crucial that Landlords are fully informed, and professionally advised, before making any BTL purchase or refinance decisions.

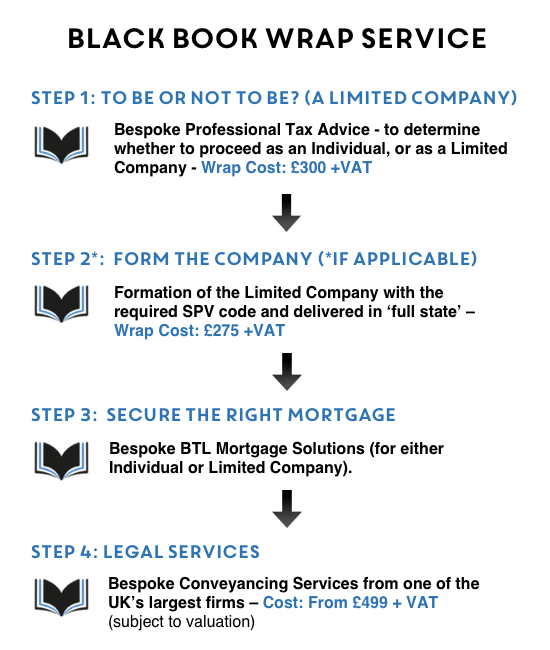

Many Landlords (and Intermediaries) are unsure about where to get the required guidance on this. Black Book has therefore launched a unique, menu-based BTL Wrap Service – with all the steps for consideration by Landlords catered for, each of which can be selected independently, depending on individual requirements.

Whether your client is considering a first-time BTL purchase, or is a large portfolio Landlord, the need for upfront tax structure planning is crucial, and your Black Book is here to help:

Call 0800 651 6511 (quoting: “BTL Wrap Services”)

or

Email BTL@blackbookfinance.co.uk

or

Enquire Online for bespoke tax advice

Keen to know more?

Advantages of a ‘Limited Company BTL’

![]() Higher Tax Relief – The incoming tax relief changes will not affect Limited Companies. Therefore, if you are a top rate tax payer, the tax payable via a Limited Company will be lower than the tax you would pay on your individual income.

Higher Tax Relief – The incoming tax relief changes will not affect Limited Companies. Therefore, if you are a top rate tax payer, the tax payable via a Limited Company will be lower than the tax you would pay on your individual income.

![]() No tax on dividends up to £5,000 for individuals – from April 2016, the ‘Dividend Tax Credit’ will be replaced by a new tax-free ‘Dividend Allowance’ of £5,000. This means you can potentially receive tax free dividend income from your investment properties via a Limited Company. If you have multiple shareholders, then potentially you could each extract up to £5,000 per year from the Limited Company, tax free.

No tax on dividends up to £5,000 for individuals – from April 2016, the ‘Dividend Tax Credit’ will be replaced by a new tax-free ‘Dividend Allowance’ of £5,000. This means you can potentially receive tax free dividend income from your investment properties via a Limited Company. If you have multiple shareholders, then potentially you could each extract up to £5,000 per year from the Limited Company, tax free.

![]() No Income Tax when re-investing profits to secure further properties. You could grow your BTL portfolio more quickly within a Limited Company as there will be no income tax on retained profit, thus allowing more available cash to re-invest. Although Corporation Tax is payable on trading profits (20%; 2015/16; reducing to 18% by 2020), this is still far lower than the higher income tax rate (40% for £31,786 to £150,000; 2015/16).

No Income Tax when re-investing profits to secure further properties. You could grow your BTL portfolio more quickly within a Limited Company as there will be no income tax on retained profit, thus allowing more available cash to re-invest. Although Corporation Tax is payable on trading profits (20%; 2015/16; reducing to 18% by 2020), this is still far lower than the higher income tax rate (40% for £31,786 to £150,000; 2015/16).

![]() Personal funds can be drawn back out of the company. Any advances you make to your Limited Company (e.g. the mortgage deposit), can be drawn back out of the company by way of a Directors Loan.

Personal funds can be drawn back out of the company. Any advances you make to your Limited Company (e.g. the mortgage deposit), can be drawn back out of the company by way of a Directors Loan.

Disadvantages of a ‘Limited Company BTL’

![]() No Capital Gains Tax (CGT) Allowance when the company sells a property – whereas individuals selling a property benefit from £11,100 CGT allowance (2015/16)

No Capital Gains Tax (CGT) Allowance when the company sells a property – whereas individuals selling a property benefit from £11,100 CGT allowance (2015/16)

![]() Additional costs of running a Limited Company – such costs include the preparation of accounts, company tax and corporation tax calculations for HMRC, filing at Companies House, legal fees, and annual auditing if applicable. Accountant’s may also charge higher fees when preparing accounts for Limited Companies.

Additional costs of running a Limited Company – such costs include the preparation of accounts, company tax and corporation tax calculations for HMRC, filing at Companies House, legal fees, and annual auditing if applicable. Accountant’s may also charge higher fees when preparing accounts for Limited Companies.

![]() Higher Mortgage Rates – In most cases, Lenders charge higher interest rates and fees for Limited Companies, as opposed to Individual Buy to Let mortgages.

Higher Mortgage Rates – In most cases, Lenders charge higher interest rates and fees for Limited Companies, as opposed to Individual Buy to Let mortgages.

![]() Reduced Choice (of lenders and mortgages) – Most lenders do not offer mortgages to Limited Companies, and when they do, the range of products tends to be much smaller. Limited Company BTL products typically range from 65% LTV up to 80% LTV.

Reduced Choice (of lenders and mortgages) – Most lenders do not offer mortgages to Limited Companies, and when they do, the range of products tends to be much smaller. Limited Company BTL products typically range from 65% LTV up to 80% LTV.

Why Black Book Finance?

Black Book has access to a broad range of BTL products for both Individuals and for those buying through a Limited Company. With our breadth of experience, we can source attractive rates and flexible criteria, to be able to offer competitive solutions every time.

![]() Experienced and first-time Landlords accepted.

Experienced and first-time Landlords accepted.

![]() A Limited Company can be new, existing, or a subsidiary.

A Limited Company can be new, existing, or a subsidiary.

![]() The SPV (Special Purpose Vehicle) is not lender specific, so there is no restriction to the use of different lenders for other properties within the same Limited Company.

The SPV (Special Purpose Vehicle) is not lender specific, so there is no restriction to the use of different lenders for other properties within the same Limited Company.

![]() Rental calculation, allows you to borrow more/deposit less, with rental calculations at just 125% of the initial payment.

Rental calculation, allows you to borrow more/deposit less, with rental calculations at just 125% of the initial payment.

![]() Up to 80% LTV available.

Up to 80% LTV available.

![]() 5 year fixed rates available from 3.49% (for Limited Companies) – 125% rental calculation, based on pay rate.

5 year fixed rates available from 3.49% (for Limited Companies) – 125% rental calculation, based on pay rate.

![]() Wide range of product options, with many specifically designed for Limited Company BTLs.

Wide range of product options, with many specifically designed for Limited Company BTLs.